I.T Elective 5:AIS MIDTERM - ACTIVITY SEATWORK(LAB)

John Edwin M. Serrano

BSIT 3A

I.T Elective 5: Accounting Information System(LAB)

Hello, My name is John Edwin M. Serrano. A 3rd Year BSIT Student from Gordon College, College of Computer Studies. This blog is my seatwork in I.T Elective 5: Accounting Information System(LAB).

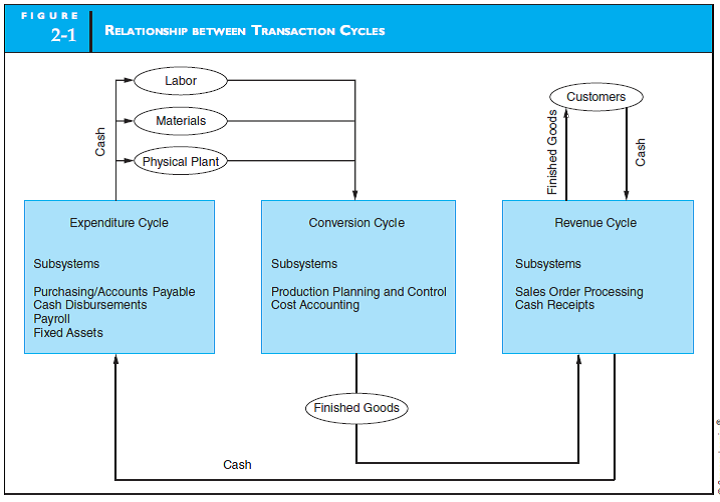

1. Transaction Cycle - An interconnected chain of business transactions. A small number of cycles that deal with the buying and selling of goods, paying suppliers and employees, and repaying lenders can be used to organize the majority of these transactions.

Subsystems of Expenditure Cycles

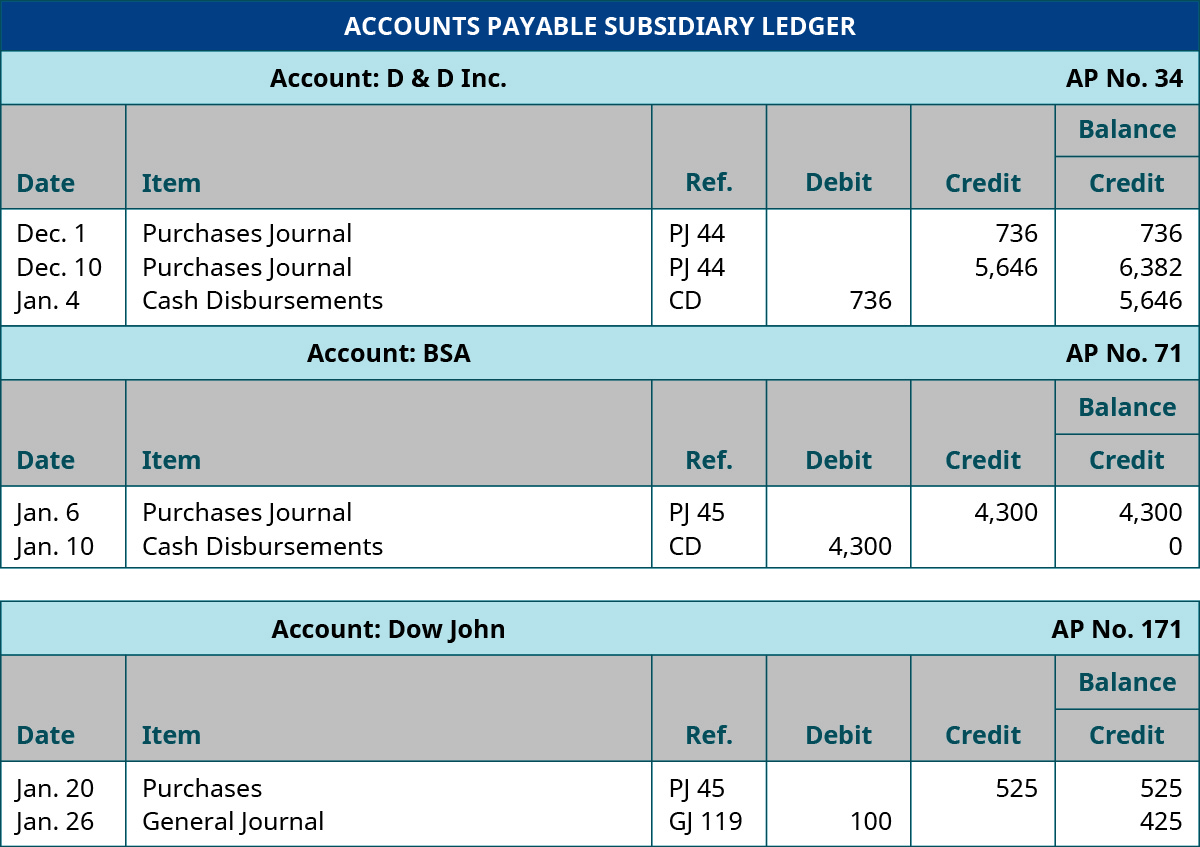

Purchases/accounts payable system. This system identifies the need to acquire physical inventory (such as raw materials) for example Places an order with the vendor. After receiving goods the purchases system records the event by increasing inventory and establishing an account payable to be paid at a later date.

Cash disbursements system is responsible for authorizing the payment, disburses the funds to the vendor and records the transaction by reducing the cash and accounts payable accounts.

Payroll system is another example of TPS that collects labor usage data for each employee, computes the payroll, and disburses paychecks to the employees.

Fixed asset system works with transactions involving the acquisition, maintenance, and disposal of its fixed assets. These are relatively permanent items that collectively often represent the organization’s largest financial investment. Examples of fixed assets include land, buildings, furniture, machinery, and motor vehicles.

2. Expenditure Cycle - It is a collection of tasks related to purchasing and paying for goods and services.

3. Conversion Cycle - Used by accounting software to record the use of labor, materials, and overhead in the production of a good or service.

The Conversion Cycle

The cost accounting system is major in this cycle and it monitors the flow of cost information related to production. It generated cost Information which is useful for inventory valuation, budgeting, cost control, performance reporting and management decisions.

The Revenue Cycle

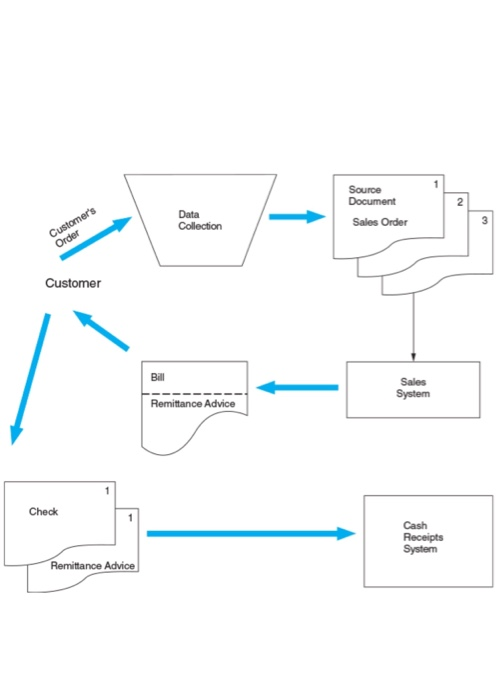

Firms sell their finished goods to customers through the revenue cycle. All transactions that include cash sales and credit sales are recorded and processed by this cycle of TPS. Revenue cycle transactions also have a physical and a financial component, which are processed separately.

Sales order processing subsystem is responsible for preparing sales orders, granting credit, shipping products (or rendering of a service) to the customer and billing customers. Cash receipts. For credit sales, some period of time (days or weeks) passes between the point of sale and the receipt of cash.

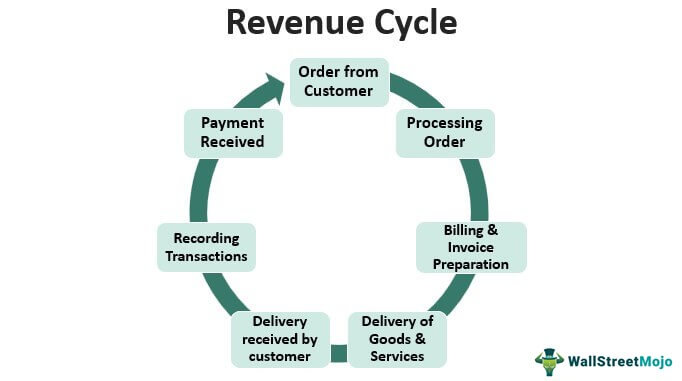

Process of Revenue Cycle

- Receive order from a customer

- Processing the order by making goods ready for delivery

- Billing and preparing invoices

- Delivery of goods and invoices to a customer

- Delivery received by a customer

- Accounts receivable records recorded

- Payment by customer

Importance of Revenue Cycle

The revenue cycle is maintained and used to check cash flow of the organization, cash flow by evaluating its profit-making activities. It helps the management decide on improvements possible by comparing the cycle of the organization with any available cycle of the competitors. It merely applies a check to the personnel involved in the process to reduce the errors. Automating the repetitive process also helps the organization provide timely and effective customer service.

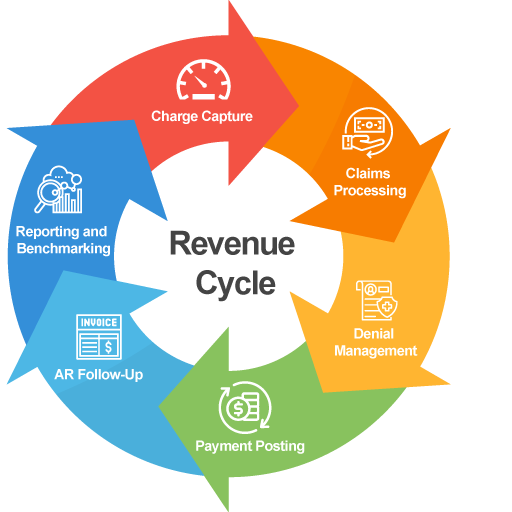

Management of Revenue Cycle helps reduce the credit period of receiving payments from the customer and lower the cases or probability of bad debts. It plays a vital role in the proper billing and receipt in the case of a healthcare facility by providing facilities for tracking registration of patients, administering personal data and insurance-related information, scheduling the appointments and billing, and receipt of the bills. Before proper implementation of the cycle organization should evaluate its fixed cost and cost-effectiveness, it also should measure whether it would be more beneficial to implement this system.

Advantages

The biggest advantage that an organization gains from the management of the cycle is the reduction in the time of receipt of the product or services of the organization to the interested customers & reduction in the time of payment received from the customers.

Adaptation of Revenue Cycle Management also helps reduce the time & cost of the management by automating the repeated processes. The cycle study helps the management decide the structure of the process, which will provide the best results and will have the best controls in managing the cycle.

It provides overall better accuracy in the billing of the product or services provided by the organization and better accounting of the transaction. The study of delay in the receipt of the payment received from the customers helps the management study the blockage of cash inflow from the different transactions, which helps the management make decisions regarding the credit periods provided to a variety of customers for maintaining the cash flow within the organization, in health industry cycle help to track all the revenue because there is the involvement of insurance company. In a few cases, payment is received directly from the patient. In some cases, they receive part payment from the patient and part payment from the insurance company. In a few cases, they receive payment directly from the insurance company, this requires lots of control, so the revenue cycle helps track all these transactions.

Disadvantages

For proper adaptation of revenue cycle management, training for the employees is necessary. If any part of the cycle makes any mistake, that thing could impact the whole cycle. Proper implementation requires expertise in accounting which may increase the company’s cost.

As explained, the cycle of the healthcare industry is complicated. The organization you have implemented this cycle will have to allocate different departments to different people so that one person won’t control all the process. For this, the organization requires hiring human resources that might increase the company’s fixed cost. There are chances of missing some important aspects of recording revenue in this industry.

Conclusion

It is an accounting process that differs from industry to industry. The service industry revenue cycle is short, and in a manufacturing company, it is a bit longer than in the service industry. It is vital to follow the cycle so that an organization can track all the revenue and the amount receivable from the debtor and track non-payment from debtors. But the organization should also consider its cost before implementing the proper revenue cycle system if it is cost-effective.

- purchase merchandise inventory to sell to customers;

- record returns of some of the inventory;

- record sales made to customers at the sales price;

- record the cost of the goods sold at the amount Macy’s paid to purchase them;

- record payments from customers;

- record returns from customers;

- purchase other kinds of items needed for operations, like office supplies and fixed assets;

- pay for prior purchases;

- pay for rent, utilities, and other services;

- pay employees;

- enter all of these transactions;

- post all transactions;

- record adjusting journal entries;

- record closing journal entries;

- keep track of its receivables, payables, and inventory; and

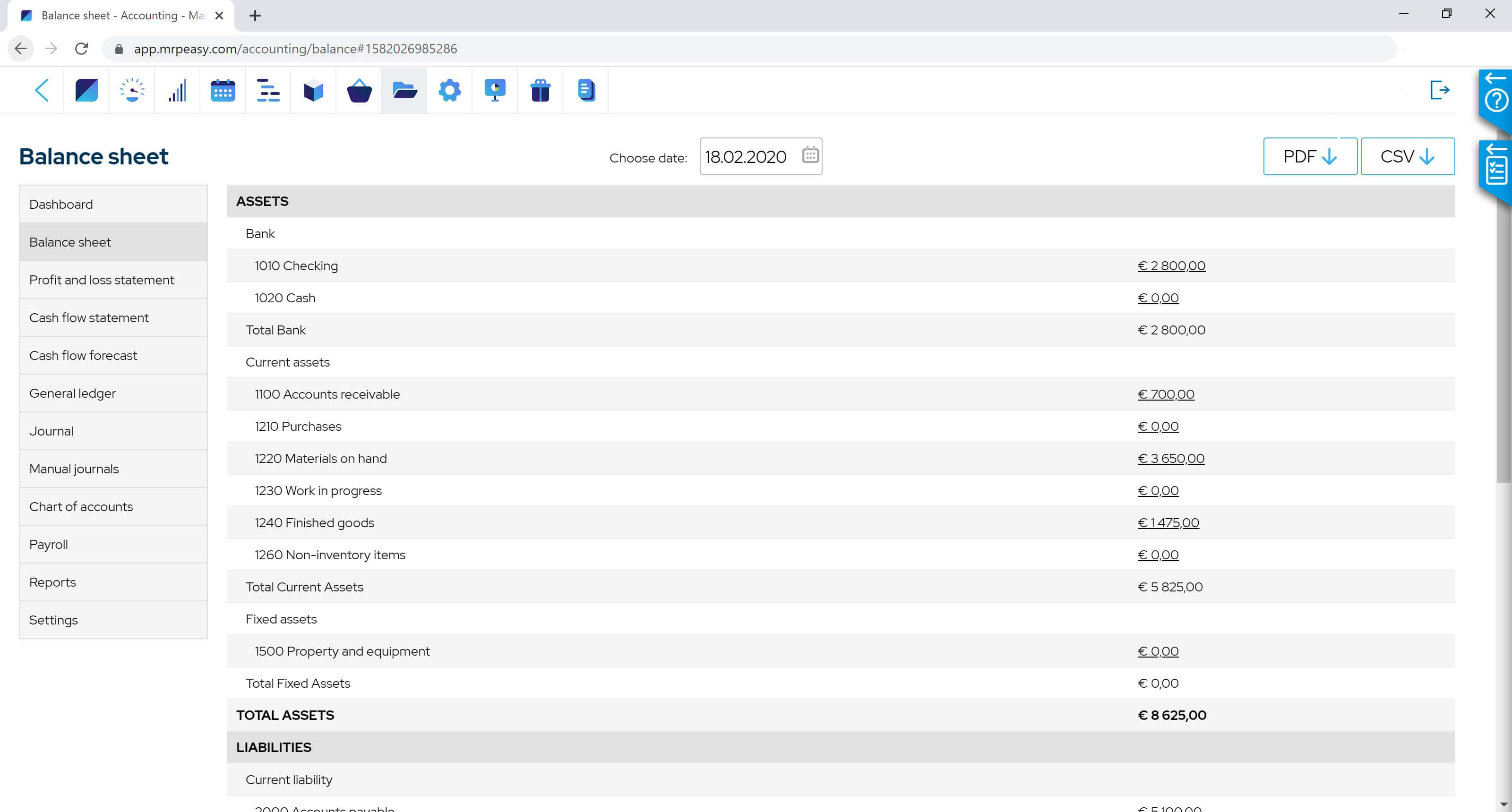

- produce financial statements for internal and external users as well as other reports useful to managers in assessing various performance measures needed to evaluate the success of the company.

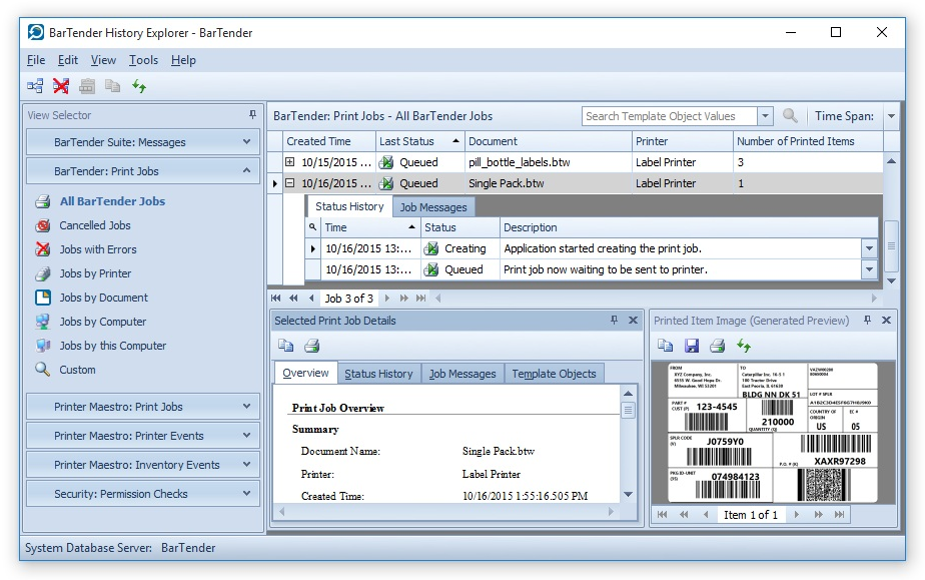

6. Product Document - Users produce and print documents like contracts, receipts, and statements using pre-set templates.

Invoice

Cash Receipt

A check from a cash register

Purchase order

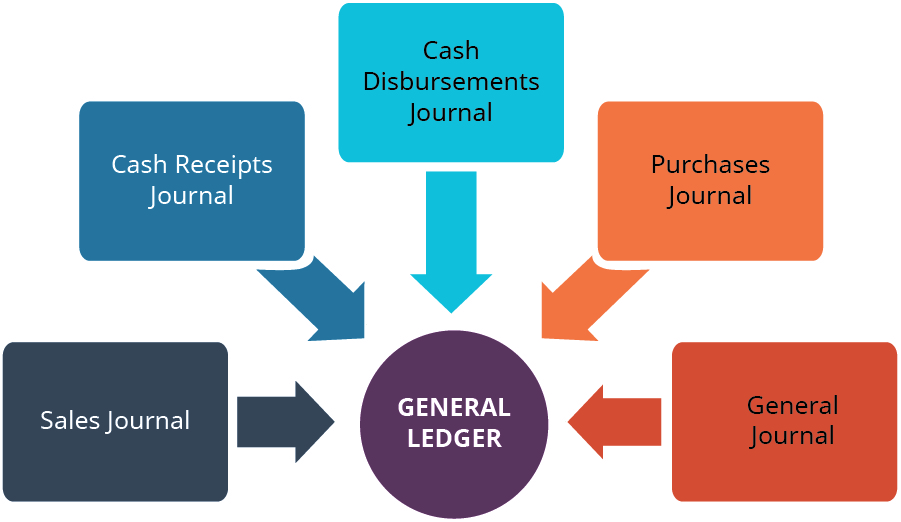

General Journal in Accounting

The general journal sometimes referred to as the nominal journal, is a journal used to record transactions which do not belong in any of the other special journals such as the sales, purchases, cash receipts and cash disbursement journals. The general journal is simply a list of journal entries in chronological order, and is used to save time, avoid cluttering the general ledger with too much detail, and to allow for segregation of duties.

General Journal Entries

The general journal is a book of prime entry and the entries in the journal are not part of the double entry posting. Typically, the general journal entries record transactions such as the following:

- Opening entries

- Adjusting entries

- Correcting entries

- Accounting period end closing entries

- Allowance for doubtful accounts

- Fixed asset purchases and sales

- Depreciation adjustments

- Goods taken for personal use

- Transfer between subsidiary ledger personal accounts

The information recorded in the journal is used to make postings to the relevant accounts in the general ledger.

Information Listed in the General Journal

The information in the general journal is taken from the relevant source documents, and each entry includes the following:

- Transaction date

- Debit: Account title, general/subsidiary ledger reference, and amount

- Credit: Account title, general/subsidiary ledger reference, and amount

- Reason for the journal entry

Impersonal Ledger

The impersonal ledger records transactions relating to income, expenses, assets, liabilities and capital. The impersonal ledger is sub-divided as follows.

Real Ledger

The real ledger contains accounts relating to assets and liabilities. It should be noted that although accounts receivable and accounts payable are real accounts they are also personal accounts and therefore held in the personal ledger.

Real accounts are balance sheet accounts and are therefore permanent accounts.

Cash is also an asset account in the real ledger but due to the level of detail required in the cash account it is normal for a business to maintain a separate subsidiary ledger known as the cash book

Private Ledger

The private ledger contains accounts relating to the management and ownership of the business, including the personal accounts of owners. As the name implies it is used to maintain the privacy of the individuals involved.

Personal Ledger

The personal ledger records transactions relating to persons such as a customer or a supplier. It should be noted that the personal ledger is not used for the capital and current accounts of the owners, these are maintained in the private ledger referred to above.

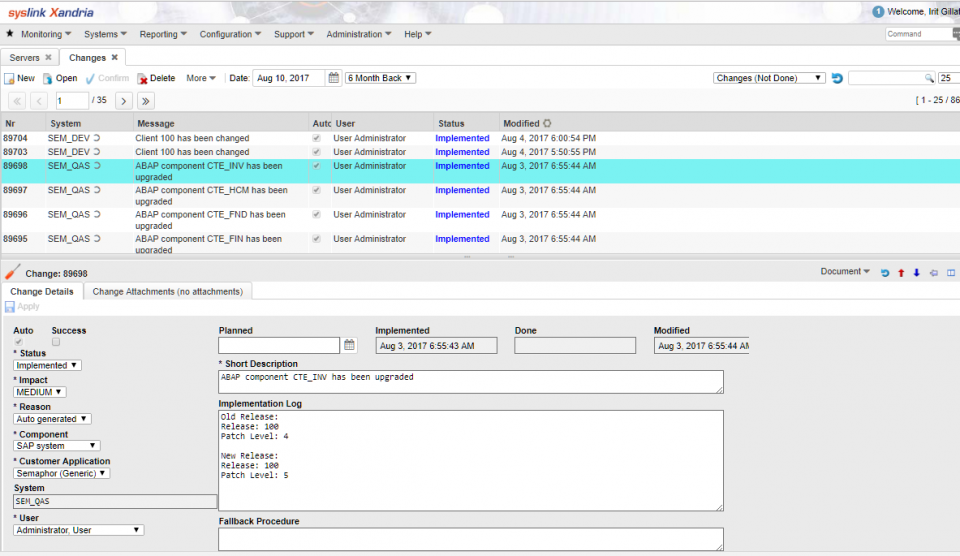

13. Digital Audit Trail - contains all of the documentation necessary to track the various steps of a commercial transaction. Along with other very important financial information, invoices and receipts are included. Contracts and salary details are also included.

(155).jpg)

Comments

Post a Comment